INO.com - Exclusive Analysis

Three Stocks To Own Right Now!

Published 1PM, May 5th, 2014

Let's not waste any time! Right now I have my sights on three stocks that just about every investor should consider adding to their portfolio.

Let's not waste any time! Right now I have my sights on three stocks that just about every investor should consider adding to their portfolio.

And I'm not talking about adding it down the road, in a few weeks or months. Nope. I feel so strongly about these companies that these stocks should get a good, hard look right now.

So, there's no time to delay - here we go!

Dr Pepper Snapple Group (DPS)

Take even the shortest jaunt through your favorite grocery story, quick stop, or other food or grocery retailer and you're bound to run into a product made by Dr Pepper Snapple (DPS). In fact, Dr Pepper Snapple's product portfolio looks like a "who's who" of the beverage industry: Dr Pepper, Canada Dry, 7Up, Crush, and A&W are just a sample of the Dr Pepper Snapple's drinks.

And it's not just carbonated soft drinks (CSD's) that lead the way at Dr Pepper Snapple. The company also boasts a robust array of non-carbonated beverages (NCBs) such as Snapple, Schweppes, Hawaiian Punch, and mixers like Mr & Mrs T and Rose's.

All told, the company produces more than 50 brands, holding an impressive 6 of the top 10 non-cola soft drink slots with a whopping 13 of its 14 leading brands ranked number 1 or number 2 in flavor categories. Talk about market dominance!

But the positive fundamental news doesn't end there. Dr Pepper Snapple has managed to turn that outstanding product portfolio into a consistent record of solid sales and increasing profits.

For the first quarter just ended, the company drove top line sales to $1.398 billion, up a bit from 2013's first quarter sales number of $1.380 billion. Not bad, especially when you consider the competitive landscape Dr Pepper Snapple has to grapple with.

But there's more. While Dr Pepper Snapple's first quarter sales nudged up compared to a year ago, the company's core income, or income from its ongoing operations, increased an eye-popping 22% to $248 million over the same period. That tells me that Dr Pepper Snapple's operations are moving along at an efficient and cost-effective pace.

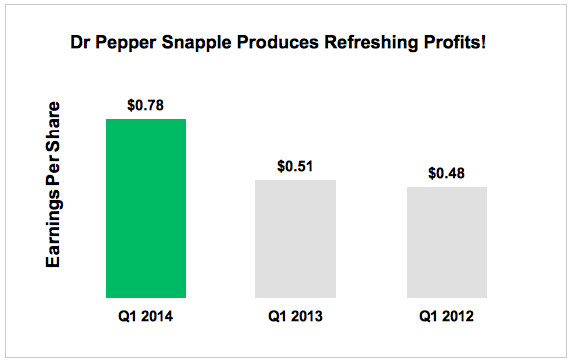

Drill down even further and you discover the best news of all: Earnings per Share (EPS) for the first quarter were 78 cents per share, up a massive 53% from a year-ago's 51 cents a share. Take a look:

Bottom-line: The outlook for Dr Pepper Snapple shares is tasty indeed. Now, let's move on to stock #2.

Colgate-Palmolive (CL)

There's nothing more exciting that taking a gander at the latest tech giant, social media innovator, or rising new age superstar company. But sometimes it's just as pleasing to take a look at a company that's been around, basically forever, and see how it measures up. And my next pick, Colgate-Palmolive (CL), measures up quite nicely.

Colgate-Palmolive was founded in 1806 and manufactures and markets a collection of consumer brands that have become synonymous with personal hygiene, household cleaning, and home care. From soap and deodorants to dish-washing detergents, household cleaners, and fabric conditioners, Colgate-Palmolive owns some of the greatest brands ever produced, including the namesake Colgate toothpaste, Palmolive dish-washing liquid, and Softsoap.

With that kind of product portfolio, it's no surprise the company, which drove sales to $17.4 billion in 2013, boasts a strong fundamental picture.

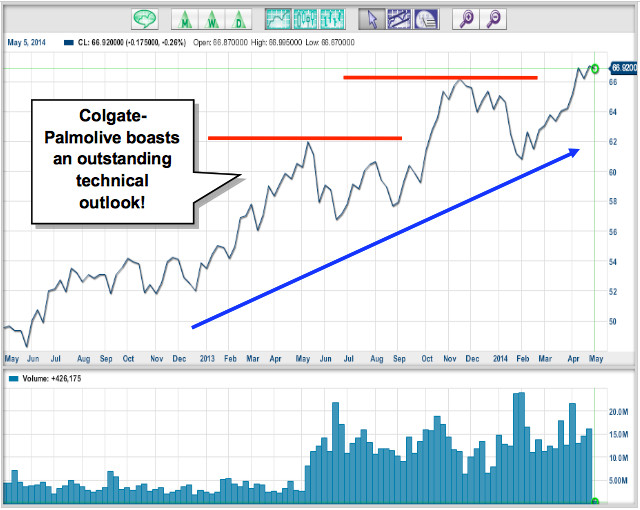

But it's the Colgate-Palmolive's technical outlook that really has me jazzed. Take a look...

As you can see from this weekly chart of Colgate-Palmolive, the shares have been on an absolute tear. In fact, when you compare the stock's year-ago price of $58 with a recent price of $67, the shares are up a handsome 15%. Not bad, especially for a company that's been around since 1806!

But there's more. In May of last year, the shares hit $62 and retreated. That's not alarming, shares that have gone up as quickly as Colgate-Palmolive's need a bit of a rest. But what's impressive is what happened next: In October, the shares tested that over-head resistance level of $62 and broke right through it.

That's a huge, positive technical sign and is a clear indication of share strength.

The story doesn't end there. Later in October of last year, the shares reached $66 and withdrew. But just like before, the shares took another stab at this over-head resistance, this time earlier this month, and broke above that important level. Technically, the shares are now set for even higher highs.

Could they pull-back like they have previously? Certainly. No stock goes straight up. But the technical power Colgate-Palmolive shares have shown is impressive indeed. Add in the company's strong fundamental outlook and these shares should earn a place in your portfolio.

Which brings to me to my third pick...

Phillips 66 (PSX)

Take a look at the latest stock chart of Phillips 66 (PSX) and you're likely to get a really big smile. In fact, the stock is pretty much on a tear. And with a recent selling price of around $84, the shares are in new 52-week high territory.

But Phillips 66 isn't just a technical story, in fact, the real deal is when you dig a bit deeper and take a hard look under the hood.

First off, you've probably seen Phillips 66 energy retail products and marketing presence. And that's no surprise: The Phillips 66 brand started in 1875 and after a spin-off from its predecessor company, ConocoPhillips, in 2012. The company now stands alone as a significant player in the energy space.

And I'm not talking a small player either: Phillips 66 boasts an outstanding asset base, including 15 refineries, 86,000 miles of pipeline, 40 billion pounds of chemical processing capacity and a stunning 10,000 brand marketers.

But there's more...

With a staggering $47 billion market capitalization (market cap), Phillips 66 stands atop the oil & gas refining and marketing industry. In fact, it towers over its nearest competitors, Valero Energy ($30 billion market cap), Marathon Petroleum ($26 billion market cap), and Williams Partners ($22 billion market cap), by a significant margin.

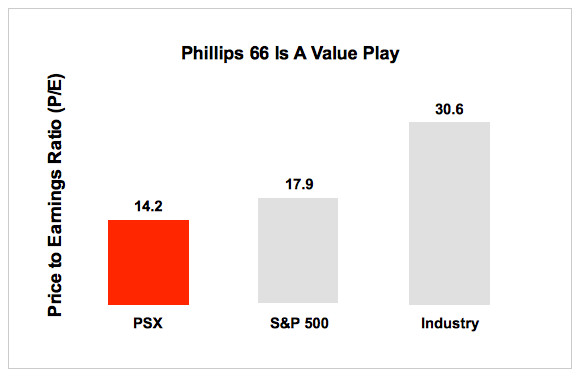

And here's the best part. In spite of its size, Phillips 66 remains a solid value play. Take a look...

Phillips 66 is now trading at a price-to-earnings (P/E) ratio of 14.2. That puts the shares undervalued compared to the 17.9 P/E ratio of the S&P 500, a good proxy for the broader U.S. stock market.

However, that's not the best valuation news for Phillips 66. When you compare Phillips 66's P/E of 14.2 to the industry's 30.6, the shares stand out as a must have value play.

In fact, with estimates calling for Phillips 66 to make $7.12 a share this year, the stock would have to rise above $218 to stand at the same P/E ratio as the company's competitors. Talk about upside!

All told, from both a technical and valuation view, Phillips 66 is worth owning.

I hope you enjoyed this report,

Wayne Burritt

Market Research Contributor

INO.com, Inc.

Market Research Contributor

INO.com, Inc.

---

Wayne has over 29 years of experience in financial writing, investment analysis, and business

development. Before starting Burritt Research, Inc. Wayne was a senior equity research analyst

and editor for Weiss Research, a nationally acclaimed independent research and advisory firm.

He directed all fundamental and editorial aspects of a variety of domestic and international

option and stock services. Prior to his tenure at Weiss, Wayne was an equity analyst, marketing

and trading specialist for Pan-American Financial Advisers, a boutique investment management

firm. He provided security analysis, marketing support, and trading services for a large portfolio

team engaging institutional and high net worth clients. Wayne also produced and starred in the

critically acclaimed stock market radio show Inside the Market while at Pan-American Financial.

Wayne has also held positions as Managing Director, Senior Credit Analyst, and Controller. He

holds an MBA from Golden Gate University and a BA in English and Philosophy from Indiana

University.

---

Wayne has over 29 years of experience in financial writing, investment analysis, and business

development. Before starting Burritt Research, Inc. Wayne was a senior equity research analyst

and editor for Weiss Research, a nationally acclaimed independent research and advisory firm.

He directed all fundamental and editorial aspects of a variety of domestic and international

option and stock services. Prior to his tenure at Weiss, Wayne was an equity analyst, marketing

and trading specialist for Pan-American Financial Advisers, a boutique investment management

firm. He provided security analysis, marketing support, and trading services for a large portfolio

team engaging institutional and high net worth clients. Wayne also produced and starred in the

critically acclaimed stock market radio show Inside the Market while at Pan-American Financial.

Wayne has also held positions as Managing Director, Senior Credit Analyst, and Controller. He

holds an MBA from Golden Gate University and a BA in English and Philosophy from Indiana

University.

---

MarketClub is owned and operated by INO.com INC (hereafter referred to as “INO”). INO is not a registered broker dealer or a registered investment advisor. No information accessed through the INO.com website or any newsletter constitutes a recommendation to buy, sell or hold any security in any jurisdiction. Please consult a broker before purchasing or selling any securities viewed or mentioned herein. INO has made every reasonable effort to ensure that the information and assumptions on which these statements and projections are based are current, reasonable, and complete. However, a variety of factors could cause actual results to differ materially from the projections, anticipated results or other expectations expressed in this release. INO makes these statements and projections in good faith, neither INO nor its management can guarantee the accuracy of some of the content in this release containing for-ward-looking information within the meaning of Section 27 A of the Securities Act of 5/27/33 and Section 21 E of the Securities Exchange Act of 6/6/34 including statements regarding expected continual growth of the profiled company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1 995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward looking statements or announcements mentioned in this release. Any investment in a company profiled by us should be made only after consultation with a qualified investment advisor and review of the publicly available financial statements and other information about the company profiled in order to verify that the investment is appropriate and suitable. Information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete.

© Copyright 1995–2014 INO.com, Inc. All Rights Reserved.

No comments:

Post a Comment